mobile money

November 8, 2017

Published by Isabel Whisson at Nov 08 2017

Categories

BRAC in Uganda shares strategy and sustainability insights from its transition from an MFI to a bank.

October 19, 2016

Published by Masrura Oishi at Oct 19 2016

Categories

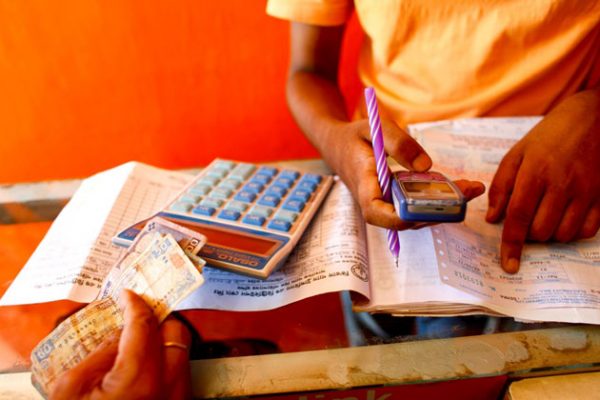

The integration of mobile money into microfinance operations is one of the most exciting yet challenging prospects facing microfinance providers today. Mobile money presents a fast, cost-efficient and flexible alternative delivery channel through which money can be transferred, loans can be repaid and savings can be deposited.

October 17, 2016

Published by Scott MacMillan at Oct 17 2016

Categories

You’d be forgiven for thinking microfinance has gone wildly out of fashion. The “development caravan”—defined as the wagon train of poverty interventions that excite donors—has pulled away from micro-lending, drawn to more powerful things like BRAC-style graduation programmes (which aim to “graduate” people from extreme poverty into a sustainable livelihood) and bKash-like mobile money, according to recent coverage in The Economist.

June 28, 2016

Published by Maria A May at Jun 28 2016

Categories

In April, BRAC, Access to Information (a2i), fhi360, USAID and IFMR LEAD jointly organised an event named ‘Digital financial inclusion: Innovations from Bangladesh’ to invite local stakeholders to discuss their experiences and emerging solutions (see a recent write-up by IMFR LEAD summarising the event).

May 30, 2016

Published by Parul Agarwal at May 30 2016

Categories

This blog draws from discussions on the progress of digital financial services, during a seminar in Dhaka in April 2016. The seminar was organised by BRAC Social Innovation Lab, Access to Information (a2i) and USAID’s mSTAR project implemented by FHI 360. IFMR LEAD was the Knowledge Partner for the event.

March 3, 2016

Published by Maria A May at Mar 03 2016

Categories

The increasing effects of climate change should be reshaping the way that we think about poverty alleviation and development. For many households, the shocks from a natural disaster can lead to increased economic and social vulnerabilities.

December 9, 2015

Published by Faruque Ahmed at Dec 09 2015

Sierra Leoneans celebrated in the streets last month when 42 days passed without a single new case of Ebola. The mix of mourning and jubilation called to mind the signing of a peace treaty after a war, and the end of Ebola should indeed be greeted as a victory.

October 29, 2015

Published by Maria A May at Oct 29 2015

Categories

For Shahina, a poor woman living in the remote rural district of Noakhali in southern Bangladesh, getting cash used to be a long ordeal. Since she didn’t have a mobile wallet, Shahina used to have to travel three kilometres to visit the local bKash agent to collect remittances sent by her husband and two sons, who were working in the city. Sometimes she was unable to make the trip without someone to watch her children. The roads are often impassable after rains and the market is far away. And often the agent charges informal ‘service fees’ before dispensing her cash.

October 21, 2015

Published by BRAC at Oct 21 2015

Categories

Stuart Rutherford is an expert in financial services for the poor, and the author of ‘The Poor and Their Money’. He founded SafeSave in 1996, to provide basic banking services in the slums of Bangladesh’s capital, Dhaka. Nearly two decades on SafeSave serves 19,000 clients, helping them afford everyday expenses and budget for bigger life events.

September 15, 2015

Published by Grace P Sengupta at Sep 15 2015

Categories

Bangladesh is a fast-growing mobile money market. With bKash, the second-largest mobile money provider in the world, industry growth in the country has reached impressive heights. Between January 2013 and February of this year, the number of mobile money clients in Bangladesh increased five-fold to 25 million users, with the number of daily transactions increasing from 10 million to 77 million.

June 7, 2015

Published by Grace P Sengupta at Jun 07 2015

Categories

While not without challenges and surprises, our experiences indicated that we should be thinking bigger, about how we could significantly scale the use of mobile money in our operations.

March 12, 2015

Published by Kazi Amit Imran at Mar 12 2015

Categories

Often community health workers (CHWs) are promised incentives for their work, but the complicated, protracted, and at times, insecure process of disbursing funds is demotivating. USAID’s Mobile Alliance for Maternal Action (MAMA) project, with the help of USAID’s mSTAR project implemented by FHI 360, pilot tested a transition from cash to mobile financial services.