Reading Time: 3 minutes

The Mapped in Bangladesh (MiB) project of the Centre for Entrepreneurship Development, BRAC University, is the first of its kind initiative to digitally map all export-oriented ready-made garment (RMG) factories through a country-wide factory census. The goal is to provide accurate information to ensure transparency and accountability within the sector.

“How many factories on the MiB map do not have BGMEA and/or BKMEA membership?” – is a common question that the MiB team receives whenever they reach out to its stakeholders, be it academicians, worker associations, trade associations, NGOs or policymakers.

There has always been a debate on the exact number of export-oriented RMG factories in Bangladesh due to a dearth of data. The official data tends to rely on factories that have membership of two apex trade associations – Bangladesh Garments Manufacturers and Exporters Association (BGMEA) and Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA). There is no official data on how many export-oriented RMG factories operate in Bangladesh without having membership of BGMEA and/or BKMEA. These factories are known, though unofficially, as non-member factories. It appears to the MiB team on many occasions that there is a constant demand among stakeholders to know details of non-member RMG factories.

Efforts to unearth details of non-member export-oriented RMG factories have not been made either from the policy level or from the realm of academic research. For example, the database of Labour Inspection Management Application (LIMA) of the Department of Inspection for Factories and Establishments (DIFE) includes the total number of registered garment factories in Bangladesh without specifying which factories are members and which are non-member factories. While RMG Bangladesh, with reference to DIFE database, mentioned approximately 800 to 1,000 garment factories operating in the country are not affiliated with any trade bodies. Centre for Policy Dialogue (CPD) in a working paper titled “Data Universe of Bangladesh RMG Enterprises”, labeled 785 factories as not-defined, because there is no information available on the status of their membership.

Thus the MiB project of CED jointly conducted a rapid survey titled “Impacts of Coronavirus on Non-member RMG Factories in Bangladesh” in partnership with Brac James P Grant School of Public Health (JPGSPH) of BRAC University and subsequently shared the findings through a webinar on 12 August 2020.

The survey team contacted 555 export-oriented non-member factories, sampled from MiB’s database, from Dhaka, Gazipur, Narayanganj and Chattogram districts through phone calls.

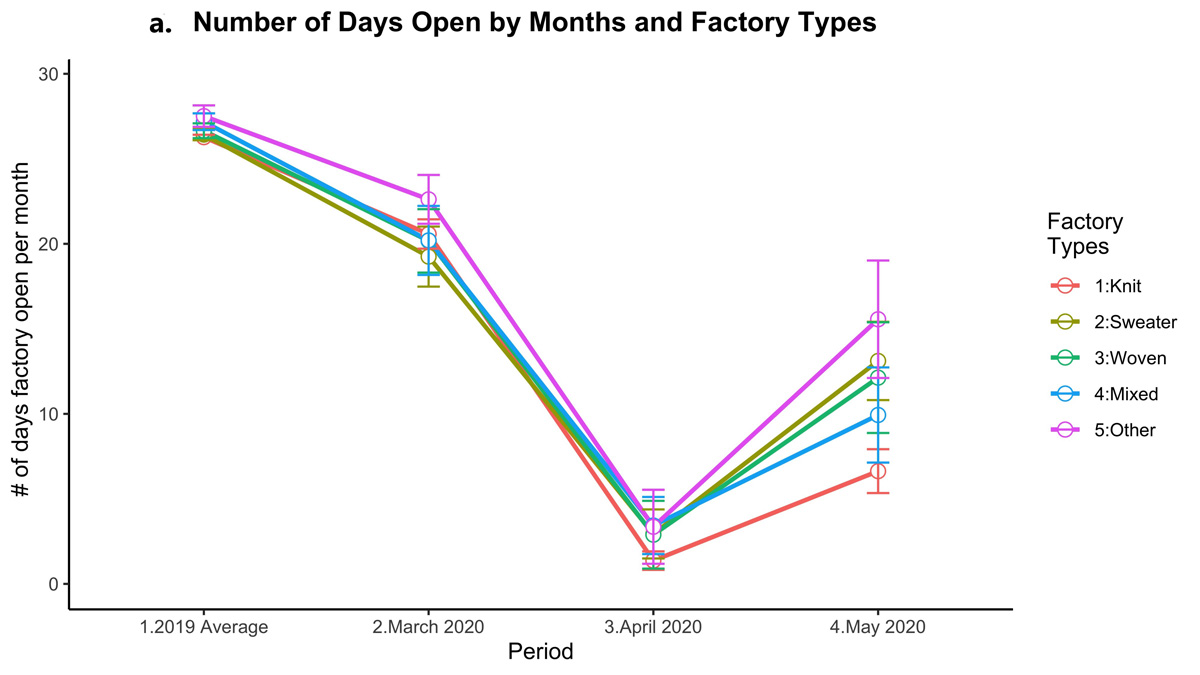

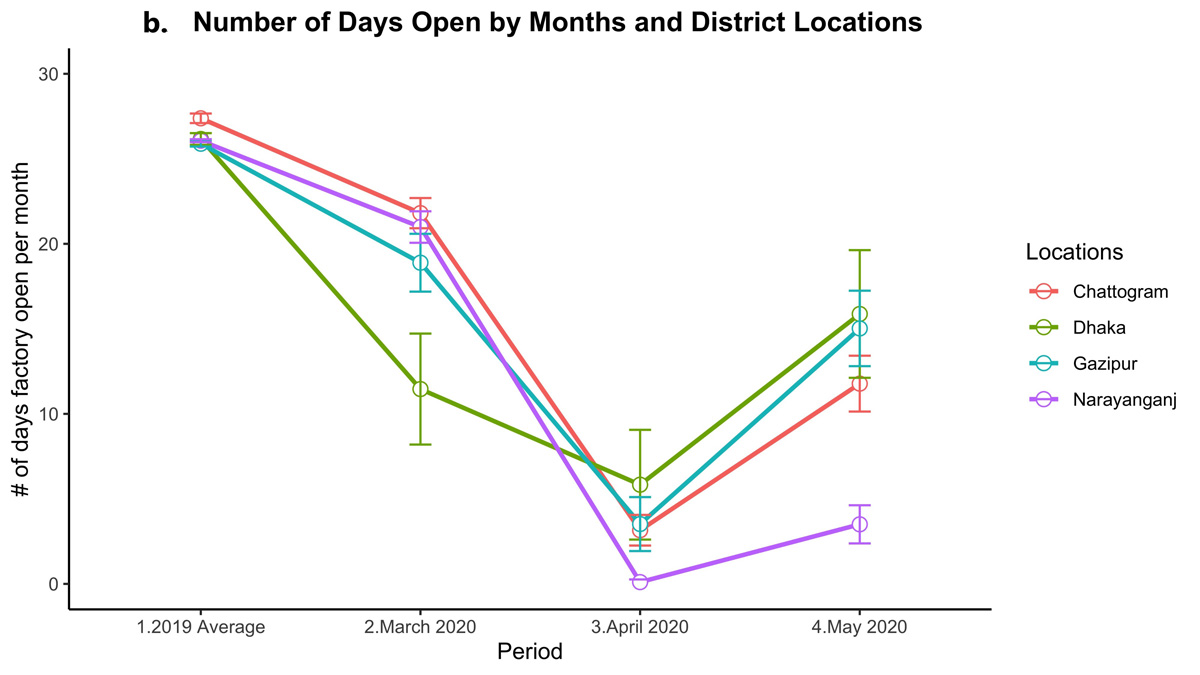

As per the research findings, 82.6% (370) non-member factories among 448 surveyed factories were operational at the time of the rapid survey (during mid-June 2020). In April, the factories were open on average for only 2.3 days. By May, factories slowly started to open and operated for approximately 9.6 days.

At the time of the survey, 86,697 workers were being employed in the surveyed factories while a total of 58,000 workers were laid off (on average 226 workers per factory) due to the pandemic.

Among the 208 factories that reported having orders in the pipeline, 61% said that the orders were still valid, 36% said that they were still in negotiation with buyers, and only 2.9% said that the orders were cancelled. The factories on average reported having two new orders.

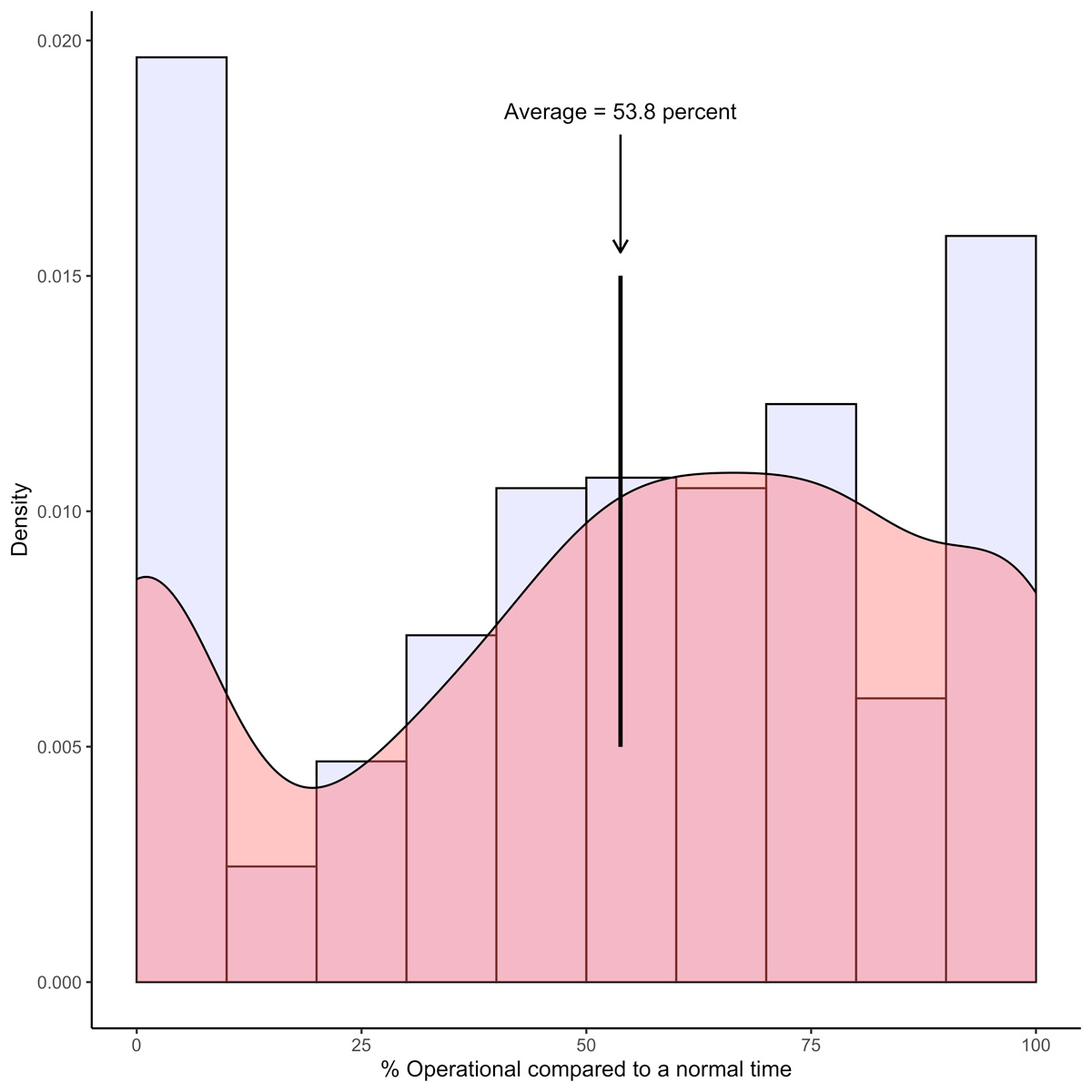

For the whole sample (n = 448), the average capacity utilisation was 53.8% and about 65.2% conditional on being open (n = 370) at the time of the survey, where the woven factories exhibited higher levels of capacity utilisation (70.8%), compared to knit (65.2%) and particularly sweater factories (56.5%).

Among all the surveyed factories, 95.1% said they were open to the government’s policy and directives to combat Covid-19. This was highest among sweater factories (97.5%), and factories from other categories (97.4%). This shows that the factories are continuing their regular operations by following directives of the government to reduce the risk and spread of Covid-19.

Findings from the survey suggest that the factories are gradually opening up which is depicted by the number of days they were operational, current employment status, current capacity utilisation and orders in pipeline. It is evident that the sector is slowly regaining its pace and we are hopeful that it will resuscitate its position like it was before the pandemic.

The speakers at the webinar recommended that small and medium entrepreneurs of non-member factories should be provided infrastructural support as well as the stimulus packages of the government for any crisis. They also stressed that non-member factories be institutionalised and come under some membership or partnership for regulation and compliance purposes.

Sadril Shajahan is a Research Associate and Fahim S Chowdhury is a Senior Research Associate at CED, BRAC University.

Photo credit: Prateek Shafi