financial education

October 19, 2016

Published by Masrura Oishi at Oct 19 2016

Categories

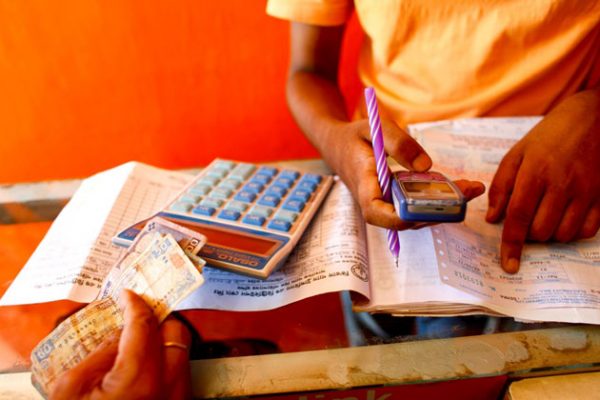

The integration of mobile money into microfinance operations is one of the most exciting yet challenging prospects facing microfinance providers today. Mobile money presents a fast, cost-efficient and flexible alternative delivery channel through which money can be transferred, loans can be repaid and savings can be deposited.

March 13, 2016

Jazirah Namukose, 18, left school feeling the sting of rejection. Classmates discriminated against her because of her disability- a clubfoot. But her life changed when she started going to the Kikaaya girls’ club in northern Kampala, Uganda. She gained skills and the confidence to start her own business- and found friends who didn’t treat her differently because of her disability.

October 4, 2015

Published by Payal Dalal at Oct 04 2015

Categories

As world leaders shepherd in a new era of international development with the UN's Global Goals, Basemera, a young girl in rural Uganda dreams about her future and that of her friends and family.

October 1, 2015

Published by Elisabeth Rhyne at Oct 01 2015

Categories

Originally posted on The Center for Financial Inclusion blog. BRAC welcomes the launch of the FI2020 Progress Report. BRAC has been an active supporter in the drive to facilitate universal financial access by 2020, having enabled the financial inclusion of over 6 million people in Bangladesh, Pakistan, Liberia, Sierra Leone, Tanzania, Uganda and Myanmar.

September 15, 2015

Published by Grace P Sengupta at Sep 15 2015

Categories

Bangladesh is a fast-growing mobile money market. With bKash, the second-largest mobile money provider in the world, industry growth in the country has reached impressive heights. Between January 2013 and February of this year, the number of mobile money clients in Bangladesh increased five-fold to 25 million users, with the number of daily transactions increasing from 10 million to 77 million.

August 2, 2015

Published by Alvina Zafar at Aug 02 2015

Categories

“I am not sure if I can repay more loans, and I don’t want to be overburdened by debt.” That was how Noyon, a small grocery shop owner with a physical disability, replied when BRAC asked whether he would like to take a loan to expand his business.

March 1, 2015

Published by Maria A May at Mar 01 2015

Categories

Even when introducing herself, Babita’s enthusiasm is contagious. “Maybe you think that you can’t change how you manage your money. It’s too hard. Well, I used to think that I could never get up in front of a group of people and give a presentation. But here I am. BRAC taught me how. So if I can do this, then you can do anything.”

December 26, 2013

Published by Scott MacMillan at Dec 26 2013

Categories

Modern microcredit, born in Bangladesh, was hailed as an innovative poverty fix when it appeared on the global radar. The United Nations dubbed 2005 “the year of microcredit,” and the following year, Mohammed Yunus and his Grameen Bank won the Nobel Peace Prize. Soon, however, the pendulum of hype swung the opposite direction, as scholars began to question the efficacy of microfinance.

July 21, 2011

Published by BRAC at Jul 21 2011

Categories

The following was originally posted by Alison Horton on America's Unofficial Ambassadors. Alison is a recipient of the AUA Mosaic Scholarship and is currently volunteering with BRAC in Bangladesh.