Tackling a process innovation challenge 101

Reading Time: 4 minutes

How did BRAC optimise its financial data management process from seven working days to 24 hours?

Change is inevitable – but also costly.

When we talk about innovation, we often refer to changing what is visible, and measurable.

But what of internal systems and processes?

Can a financial management process that took seven working days to wrap up, be optimised to under one day? Here’s how BRAC, the world’s largest non-governmental development organisation, innovated their monthly finance consolidation system.

The Problem

In Bangladesh, BRAC has over 3,000 microfinance branches, along with several development programmes, head office operations, and other cost centres. The sheer number and diversity of operational models and the resultant financial data has always posed a challenge to consolidate and streamline at a central level.

The ‘traditional way of doing things’ had accountants across Bangladesh consolidate finances at the end of every month locally for their respective branches, and then courier the month-end report in a compact disk (CD) to the head office for aggregation. Paper statements and bills were also mailed – as documented evidence – to the head office, where they were archived indefinitely.

If any of the CDs had errors, the whole process was put on hold. Identifying errors and troubleshooting to rectify took up upto 7-10 working days. Monthly deadlines were frequently missed in preparing and submitting the accounts- frustrating everyone involved.

Unpacking the problem

Realising the need to speed up data transmission from the field to Head Office, BRAC’s finance and accounts department (F&A) assembled a project team to delve into the problem.

The project team visited different branch offices to understand lags in the system, and they removed a few bottlenecks to reduce transition time. This helped speed up data transmission by a couple of days, but the team was determined to streamline it further.

They theorised that taking the entire process online would speed up the transmission time, and at the same time cut out the associated costs for CD and paper shipment.

Prototyping to learn

The team decided to test with live data updates using Google Drive.

Accountants would upload the monthly data directly on the Drive, which would then be consolidated at the Head Office.

The system was piloted in a few remote branches across Bangladesh. On average, it took around eight hours to upload the necessary data. In one branch, just five minutes after the upload was complete, the electricity went out – an event which could have derailed the entire process had it occurred earlier!

So, the team went back to the drawing board.

And stumbled upon a startling realisation…

The online transmission was being so time-consuming because branch accountants were sending data aggregated over a long period of time, not just from a particular month.

The quick fix-it was to have the branch accountants upload only the current month’s data at branch level, and then have the F&A team compile and maintain the historical data at the head office level.

However, this still would not make the data transfer free from delays caused by electrical load shedding and the like.

Reiterating to fit the context better

The project team then approached their software vendor, Southtech, to find a way to collect data online directly from field by reconfiguring the existing software the F&A head office team was using to aggregate the monthly financial data for analysing.

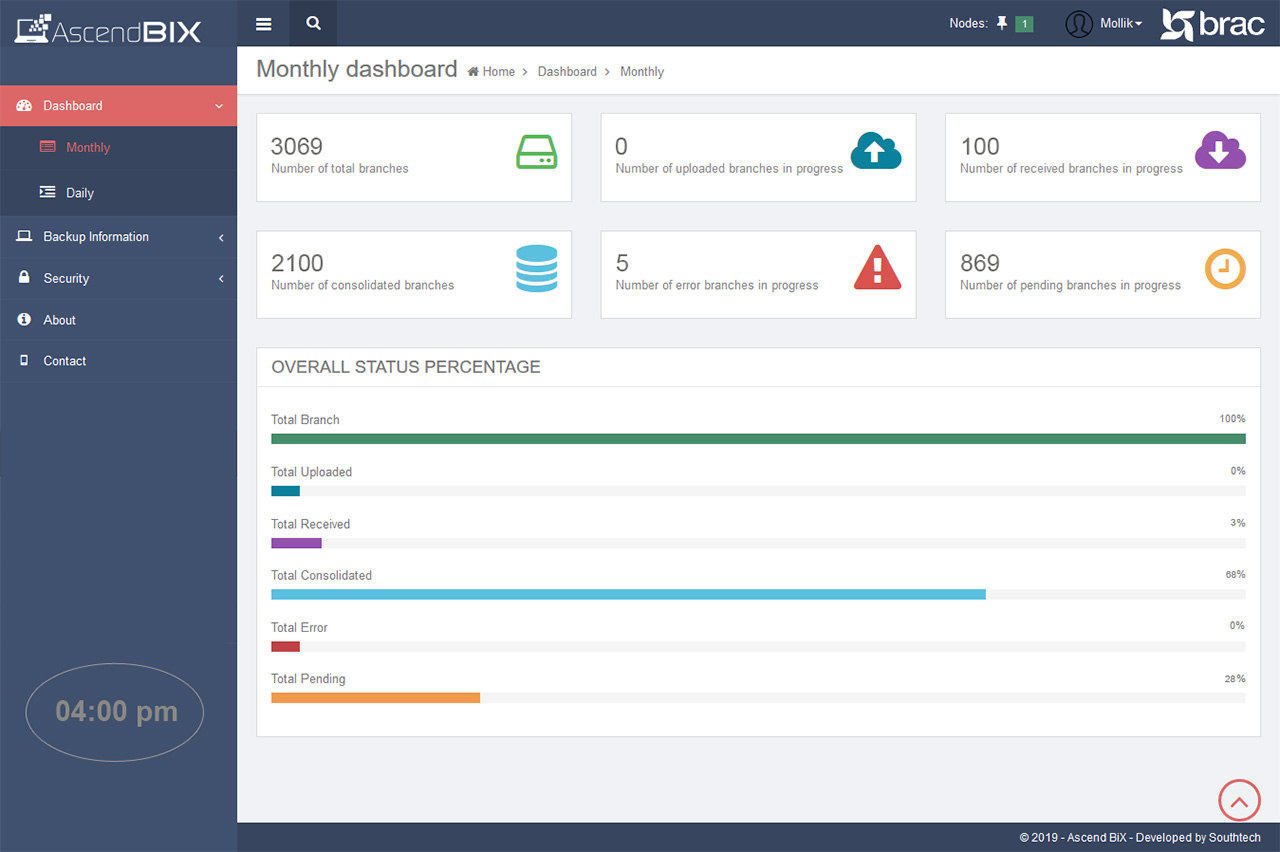

Integrated dashboard to ensure check and balance of live data

After rounds of discussion, they arrived at a version that would allow field office accountants to directly upload monthly data to the platform, while allowing the head office team to aggregate the total accounts online too.

If load shedding occurred, the transmission would be only be stalled until electricity returned. The accountants would not need to restart the upload from scratch again.

Testing small before deciding to scale

The team tested the functionality of the updated software by inputting a number of archived monthly data from the head office into the platform, and testing for discrepancies from the original analysis.

When found to be accurate, the same test was carried out with old data of 50 randomised branches across the country. After verifying it, F&A finally went live, testing data from 200 branches at once. Once that was successful, the team decided to scale the system.

Testing the solution in different regions and circumstances

In November 2017, the system was rolled out in all branches and cost centers across Bangladesh.

Preparing for implementing change

The system update required training accountants country-wide to adopt a new system – a process which could have been time-consuming and labour-intensive.

Fortunately, the field accountants were already using online applications for other reporting purposes, and required only minimal instructions for using the updated software.

Southtech pledged standby technological and hardware support across Bangladesh, in case of problems faced with transmission, and this also made the transition easier.

Now, F&A can see live data transacting from branch offices on a real-time dashboard. Problematic branches can be immediately identified, and troubleshooting could happen within hours.

“This was an easy transition, shifting to the new system. We were already doing a lot of miscellaneous tasks online, and this was a simple change in comparison,” mused Mr Mohibul, the sub-district accounts manager of the Birol branch in northern Bangladesh.

The branch, he estimates, now consumes 50% less paper on average than before. And the new system helps save on courier fees. When asked for comments, other branch accountants agreed with his assessment.

The process now takes a single working day for all cost centres across Bangladesh.

And sure, the system saves paper and courier costs, but was this an expensive change?

“The software only took BDT 10 lakh (almost USD 12,000) to integrate, and we will surely be reaping the benefits for a long time to come,” beamed Mr Ashit, the man helming the project team tasked for this innovation. By being as frugal as possible, the team made it possible to reduce reporting time by almost 7 days, and save costs in purchase and transport of CDs and paper.

F&A did not directly jump into investing in a software, but by analysing the causes of the problem, and prototyping rapidly and reiteratively, they were able to arrive at a solution that is secure, paperless and stress-free for all parties involved.

The F&A team now meets their consolidation and analysis deadlines on time, every time, and are rearing to see what else they can improve systematically using such lean practices.

Shafqat Aurin is an Interaction Designer with the BRAC Social Innovation Lab; Nishat Tasnim is a Deputy Manager, Innovation Ecosystem and Partnerships with the BRAC Social Innovation Lab.