Scaling up crop insurance to tackle the global food crisis: Insights from Bangladesh

Reading Time: 5 minutes

The world is already facing a global food crisis, and it is expected to worsen, with climate impacts anticipated to wipe out 30% of the world’s food production by 2050. Our biggest strength in facing this crisis are the people most exposed to it – smallholder farmers, who produce one-third of the world’s food. Insights from Bangladesh provide valuable guidance on how crop insurance can support these farmers to tackle the challenges ahead.

“Potato crops are like procrastinating students before exams – they do most of the work in the last week of their growth cycle.” muses Shakila Akter.

“Last year, I was a week away from harvesting my 0.1 acre of potatoes when a coldwave dawned early. I watched my plants shrivel and I could feel the shrinking harvest hidden under the soil waiting for me”.

Northwestern Bangladesh, where Shakila lives and farms, is known for extreme weather. The climate crisis is exacerbating the extremes, with winters rapidly getting colder and summer temperatures testing thermometers – and the heat tolerance of farmers. Shakila lives in Gaibandha, a district where every second person lives in poverty.

“The gut wrenching feeling of watching a crop getting destroyed isn’t new, but it never gets easier. This year I looked at the field and all I could see was another year of borrowing money to afford my daughter’s school fees,” said Shakila.

This year was different, though. It was the first year Shakila had insured her crop. Within 20 days, she received an insurance payout – which was triggered automatically when the temperature dropped below 10 degree celsius for three consecutive days – for all farmers insured in that area. Shakila received BDT 1,000, which was enough to pay for her daughter’s school supplies and fees for the year with BDT 200 to spare.

There’s a saying in our region – farmers feed the nation, and pay for it with their lives. Maybe, with things like this, we can change that.

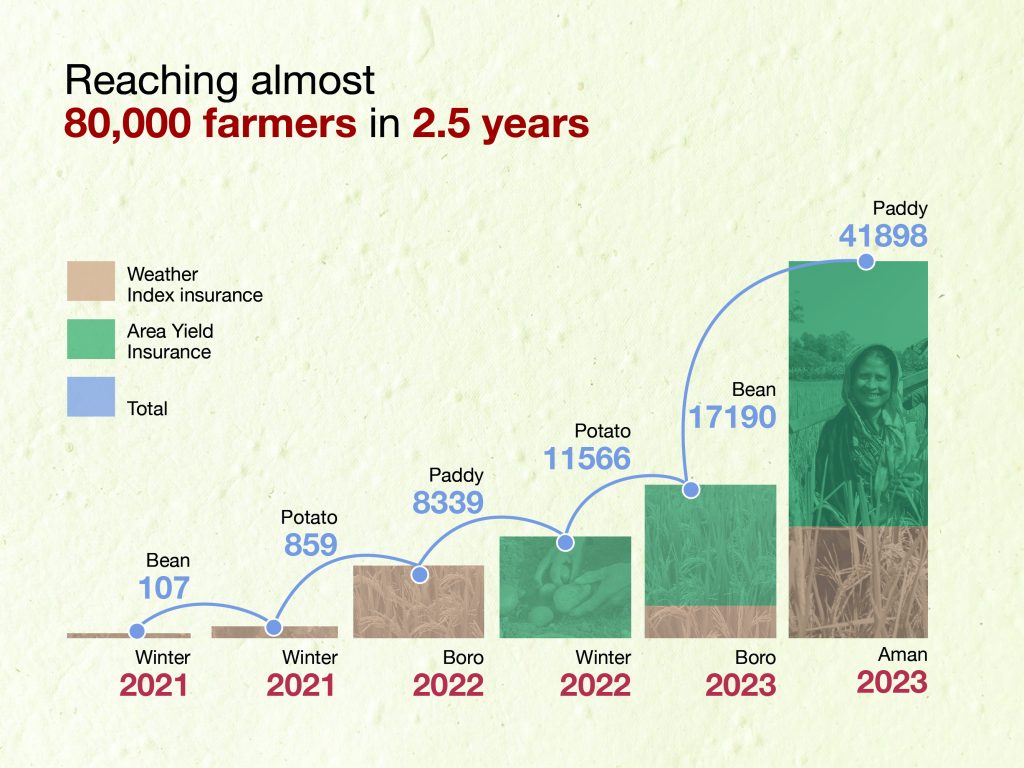

How to scale: Insuring 80,000 farmers in 30 months

Crop insurance has emerged as a key climate adaptation tool for smallholder farmers across the world. At its core, it works like any other insurance – you pay a premium to insure your crop against a climate shock that might impact your yield, and you receive a payout if that climate shock occurs.

Bangladesh has made huge gains in food security over the past two decades, is the world’s third biggest rice producer, and is self-sustainable in a number of crops. The climate crisis is increasingly threatening to undo those gains.

We provide finance to approximately 10 million people, many of whom use the loans for small-scale farming, and many of whom have been reporting unprecedented losses. We traditionally have three crop seasons for six seasons in Bangladesh – grishmo (summer), borsha (monsoon), shorot (autumn), hemonto (late autumn), sheet (winter) and boshonto (spring) – but now all of those seasons are seeing climate shocks.

In response, particularly to increased unseasonal rainfall, intensifying cold waves and excessive heat, BRAC started offering crop insurance to farmers in Bangladesh in 2021. We partnered with Syngenta Foundation for Sustainable Agriculture, Green Delta Insurance Company and Bangladesh’s only government general insurance provider Sadharan Bima Corporation.

It was a tough time to launch. The world was still grappling with the impacts of COVID-19 and Bangladesh was still in lockdown – but we started because many smallholder farmers were hit badly by the pandemic, and we wanted to start supporting them to build their resilience as soon as possible.

Bangladesh has made huge gains in food security over the past two decades, is the world’s third biggest rice producer, and is self-sustainable in a number of crops.

The first product we launched was weather index-based crop insurance, which pays out based on a parametric index, such as rainfall, which is measured at a local weather station or by satellite. At the start, processing insurance claims was simple and payouts were quick.

As we expanded access to more farmers, however, gaps began to appear. One major one was farmers losing crops because of reasons that were not directly related to the weather in their immediate surroundings. Bangladesh’s two major rivers, Jamuna and Brahmaputra, begin in Nepal and flow through India before entering Bangladesh, and farmers living in the char (river island) regions in northwestern Bangladesh lose more crops to floods resulting from rainfall in the adjacent Indian states of Meghalaya or Assam than to rainfall in their locality.

Another was pest attacks, which would occur in an area because of a climate shock there, and then swarm to another area and destroy the crops there. There were also disputes, because climate shocks do not follow neat boundaries, where the real losses of farmers on the ground just didn’t match the reading from the distant weather stations or satellites.

In response to these gaps – which are known as basis risk in the world of insurance, we added area yield index insurance, through two new partners – Pula and Reliance Insurance Limited. Area yield insurance is triggered by an indicator much closer to the lived experiences of farmers on the ground – their yield. The average yield for their crop is calculated in advance, and they are paid out as soon as the yield drops below a set percentage of that average.

The results have been impressive. Almost 80,000 farmers and 10,000 acres of crops have been insured within just two and a half years, and 9,000 farmers have received payouts totalling worth BDT 3.7 million over three cropping seasons. At a household level, this means increased resilience against increasing shocks, and at a national level it means increased food security. With 85% of the farmers in Bangladesh being smallholder farmers, the impact of strengthening resilience extends far beyond just income. The positive response from farmers has resulted in crop insurance now being offered as part of the microfinance programme package.

What’s next?

There’s still a lot of work to do to develop the right model for crop insurance in Bangladesh. Raising awareness about crop insurance as an effective climate adaptation tool among farmers is a key starting point.

Uptake of insurance by farmers was quite slow when the first product was launched as the premium was not subsidised and the insurance was not embedded in loans or savings unlike previous attempts by other initiatives. But it has been increasing quickly.

Many people tend to underestimate smallholder farmers’ capacity to pay the premium. But we found if the farmers got to know of the value it brought to them – they were more than willing to be part of the crop insurance initiative. That’s why investing in raising awareness of crop insurance is vital.

Renewal rates have also been increasing, and are currently sitting at 57% – meaning over half the farmers who have taken insurance out once are choosing to take it out a second time. These numbers are the result of an intensive effort to raise awareness by a dedicated in-house team of agronomists, meteorologists and insurance experts.

Equipped with the right tools, knowledge and platforms, smallholder farmers are some of the world’s most innovative, entrepreneurial and resilient people.

We’ve also been looking at complementary services, such as agri-advisory calls, so that insured farmers receive hands-on farming advice as well as free weekly weather forecast information over mobile phone calls. This is showing impressive early results in terms of supporting farmers to make better decisions and saving input costs.

Lastly, we’ve been working on establishing forward-backward market linkages so farmers can buy inputs and sell produce at fair prices. We are currently working with organisations to enable insured farmers to sell their produce at their farms, rather than having to travel to markets or negotiate with middlemen.

With the world already facing a global food crisis, and climate impacts rapidly accelerating, the need for resilience-building tools like crop insurance is only going to increase. Smallholder farmers make up 84% of farmers globally, produce one-third of our food and – equipped with the right tools, knowledge and platforms – are some of the world’s most innovative, entrepreneurial and resilient people. Bangladesh’s experience in making crop insurance work for smallholder farmers can provide valuable insights for other countries in the global south, and the rest of the world, on how we can best support farmers – and in turn the global food supply that our collective survival relies on.

Bangladesh is an example that climate adaptation can work, but it needs to be better financed and better implemented. Three principles are crucial – that adaptation is a nexus of development-humanitarian-climate programming, that special attention is given to the most vulnerable communities and that adaptation is locally-led.

Monirul Hoque is the Insurance Lead at BRAC Microfinance in Bangladesh.