Don’t fear the data reaper

Reading Time: 3 minutes

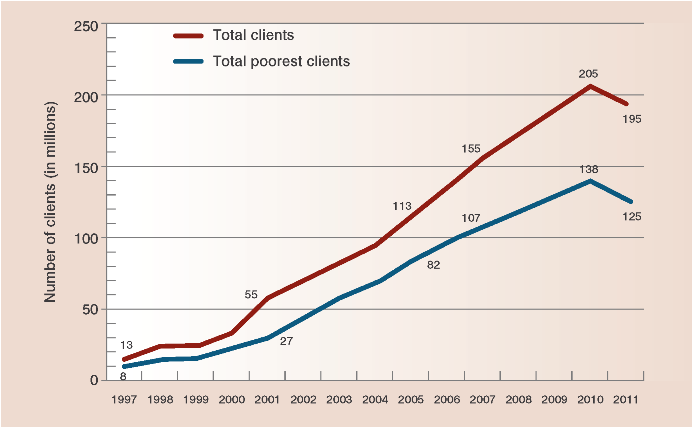

The number of people worldwide reached by microfinance institutions (MFIs) fell in 2011, the first time in 13 years, according to the Microcredit Summit Campaign’s (MSC) brand new report.

The number of people worldwide reached by microfinance institutions (MFIs) fell in 2011, the first time in 13 years, according to the Microcredit Summit Campaign’s (MSC) brand new report.

Upon digging deeper, one finds reasons for both vigilance and hopefulness about the future of microfinance. This report might be the largest indicator yet of a new era of heightened sensitivity to data on the part of microfinance institutions (MFIs).

Two years ago, in the immediate aftermath of the microfinance crisis in Andhra Pradesh, BRAC’s Shameran Abed asked if some providers in Bangladesh had been “cavalier to the point of being reckless” about the amount of loans given to clients.” Large providers in Bangladesh seemed to be revising growth targets downward, he wrote.

We see that now reflected in current data. In the report’s top ten reasons fewer loans are going to the poorest, the ninth reads: “What once were the fastest growing microfinance markets in the world, such as Bangladesh and Latin America, have reached a point where a large proportion of the people most easily reached have already become clients.” So the growth of microfinance institutions (MFIs) there is naturally slowing.

But see also reason number three, better data:

In the past few years, many MFIs have more widely adapted poverty measurement tools, such as the Progress out of Poverty Index®, Poverty Assessment Tool, and the Food Security Survey. The MFIs that employ these tools often find that the number of the poorest that they are serving is less than they originally estimated. This means that some of the reduction in numbers of the poorest being served reported to us is due to more accurate reporting on the number of poorest clients.

This is encouraging. As Bill Gates just heralded in his 2013 annual letter, we need better measurement tools to determine which approaches work and which do not. It shouldn’t surprise anyone that on some measures, better tools will result in smaller numbers – whether that measure is people reached, or how much their lives have really improved.

We asked Shameran Abed, head of BRAC’s microfinance program, for his thoughts on the latest MSC report. He says he suspects there was previously a lot of double and triple counting of borrowers and clients that is now being corrected. “In Bangladesh for example, I have heard people quote figures as high as 24 million microfinance clients, which is absurd given that almost every MFI lends only to women and given that there are only 30 million households in the country.”

If that’s the case, it’s possible that the number of microfinance borrowers worldwide continues to grow, and that previous numbers were simply exaggerated due to poor data. In fact, even more recent figures from the Microfinance Institutions Network seem to show there is a recovery underway in India’s microfinance market.

That MFIs are reporting lower numbers or slower growth is a good sign that they’re taking new measurement tools seriously. Nonprofits and development organizations have nothing to fear from better information. Ultimately, better information allows us to be more vigilant, especially as microfinance continues to expand in younger markets.

In Africa, for example, although overall microfinance growth is accelerating, BRAC is actually scaling down lending in some markets where we found it simply wasn’t effective, such as South Sudan. We’re placing renewed emphasis on livelihood training, education programs and adolescent girls’ empowerment there – keeping an eye out for the right moment to introduce microfinance, if and when that comes.

Meanwhile, BRAC’s microfinance program remains strong and growing in neighboring Uganda, largely thanks to our partnership with The MasterCard Foundation, which includes a strong data collection and research component (see “A dividend from investing in girls? World Bank blogger (and previous skeptic) weighs in”).

Microfinance can be a powerful tool for creating freedom and opportunity for the poor. But it’s not the only tool, and sometimes it doesn’t work. No matter which tool you’re experimenting with – be it microfinance, community-based healthcare, education or social enterprise – it shouldn’t cause fear when the data shows it’s not working the way we expect. The bigger risk would be to collect no data at all.