Digital cash: The future of humanitarian response?

Reading Time: 3 minutes

Global humanitarian crises – and the aid systems that respond to them – are undergoing massive change. More people are in crisis than ever before.

At the end of 2018, 70.8 million people were forcibly displaced as a result of persecution, violence, conflict and human rights violations.

The future does not look any better.

UN forecasts predict that the number of environmental migrants could go upto 1 billion by 2050. This propels us to be prepared with innovative systems.

Humanitarian crisis and our preparedness to fight it can be questioned in so many ways. What works best for a humanitarian crisis situation?

Traditional humanitarian response was based on non-cash transfers, where goods and services were provided by aid workers. However, often in emergencies, this system was often proven to be ineffective. After the immediate response, the goods and services that people need varies from individuals to households.

That is where the cash transfer programmes came in. The humanitarian sector is transforming how it responds to crises to tackle rising numbers. It has shifted its approach from commodity-based assistance to cash-based interventions.

Cash programmes work for longer term of assistance and while preparing for natural disasters. Cash payments through digital financial services (DFS) can provide heightened security, increased accountability and transparency, faster distribution and a scalable transfer model. Early examples of digital cash payments include supporting Ebola response workers in Sierra Leone and monthly aid stipends to refugees in Dadaab refugee camp in Kenya.

Cash based interventions can not only help affected households get access to aid during crises, but also prepare them to tackle future risks and shocks. To enhance preparedness in crises, BRAC has contextualised solutions based on the circumstances it works in.

Back in 2015, monsoon floods in northwestern Bangladesh affected over one million people. Crops and seed beds were washed away, eliminating incomes for many farmers and day labourers. Lack of clean water sources led to outbreaks of diarrhea, especially for displaced families. For many poor households, one of the post-flood priorities was replanting their crops to mitigate economic losses as much as possible.

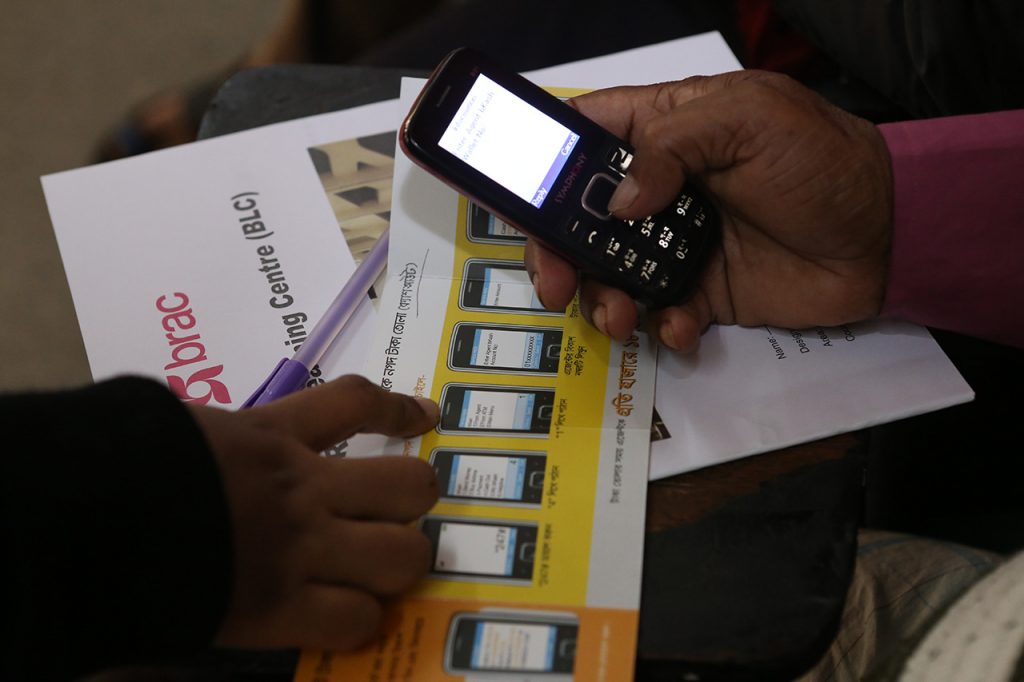

We responded with mobile money to help those affected get back on their feet. Almost 3,000 marginalised farmers and households were able to recover what they lost, and start cultivating winter vegetables with the cash support provided to them. For the long-term solution, the community created a disaster fund to tackle the immediate crisis from floods.

BRAC also partnered with OXFAM to practically test the e-voucher based relief distribution in flood affected areas of Gaibandha district in northern Bangladesh. It introduced e-voucher relief and cash transfer via mobile money (bKash) in the aftermath of monsoon flood for marginalised farmers and women.

For the Rana Plaza victims in 2015, BRAC transferred the monthly interest of the bank fixed deposit via mobile money to help survivors rebuild their lives. This proved to be convenient for many survivors who migrated to other parts of Bangladesh due to the accident. The innovative solution secured the transaction process and reduced the difficulty of travelling to a different location to obtain cash support.

Ripon, 40 years old, one of the survivors of Rana Plaza who benefitted from digital cash transactions

Most of the survivors have access to bKash accounts and received monthly interest on the fixed deposits through bKash. Previously, to collect this money, the survivors had to travel to the nearest BRAC microfinance offices, which was a difficult task for many.

Then what is stopping us to go for cash based interventions?

Often it is still insufficient mobile network, inadequate access to local agents and merchants, and the funds traceability factor.

Fortunately for Bangladesh, it is deemed to be the leader in mobile money adoption.

Almost 25 million adults in Bangladesh have a mobile money account – approximately over one-fifth of the entire adult population. There are also 13 mobile money platforms competing in the market. This gives Bangladesh’s humanitarian sector a unique opportunity to increasingly involve mobile money platforms in response mechanisms in the future.

Monira Parvin is a senior manager, Knowledge Management, BRAC Humanitarian Programme

Nishat Tasnim is a deputy manager, Innovation Ecosystem and Partnerships BRAC Social Innovation Lab